GWPF | 27 Nov 2015

Abengoa is a Spanish company that was another of President Obama’s personally picked green energy projects, and it’s now on the verge of bankruptcy, potentially saddling taxpayers with a multibillion-dollar tab and fueling the notion that the administration repeatedly gambles on losers in the energy sector. The renewable energy firm said Wednesday it will begin insolvency proceedings, a technical first step toward a possible bankruptcy. International banks’ total exposure to a full Abengoa bankruptcy stands at about $21.4 billion, according to Reuters news agency, meaning the company’s downfall would end up being the largest bankruptcy in Spanish history. –Ben Wolfgang, The Washington Times, 25 November 2015

1) Stranded Assets: Solar Company Faces Biggest Bankruptcy In Spanish History – The Washington Times, 25 November 2015

2) New Survey: Public Support For Tough Climate Deal Declines – BBC News, 27 November 2015

3) At Last! Fracking To Start In Months As Minister Fast-Tracks Decisions – The Times, 27 November 2015

4) Many Green Power Farms Planned For UK ‘Will Not Be Built’ – The Independent, 27 November 2015

5) Reminder: Owen Patterson Calls For Mini-Nuclear Plants By The Dozen At GWPF Lecture – Financial Times, 15 October 2014

6) George Osborne Puts UK At The Heart Of Global Race For Mini-Nuclear Reactors – The Guardian, 24 November 2015

7) Rupert Darwall: The Night Britain’s Lights Went Out – The Wall Street Journal, 27 November 2015

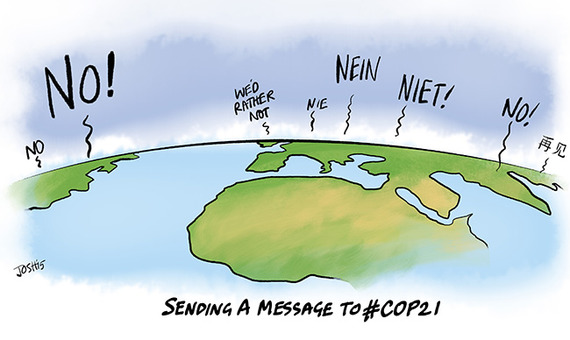

Public support for a strong global deal on climate change has declined, according to a poll carried out in 20 countries. Only four now have majorities in favour of their governments setting ambitious targets at a global conference in Paris. In a similar poll before the Copenhagen meeting in 2009, eight countries had majorities favouring tough action. Just under half of all those surveyed viewed climate change as a “very serious” problem this year, compared with 63% in 2009. The findings will make sober reading for global political leaders, who will gather in Paris next week for the start of the United Nations climate conference, known as COP21. –Matt McGrath, BBC News, 27 November 2015

Fracking could start in Britain within months after the government intervened to fast-track applications to drill shale gas wells in Lancashire. Greg Clark, the communities secretary, wrote to lawyers for Cuadrilla yesterday saying that he had decided to have the final say on its appeals against Lancashire county council’s rejection of its fracking applications. The government has pledged to go “all out for shale” and in August announced changes in planning rules under which such appeals “will be treated as a priority for urgent resolution”. –Ben Webster, The Times, 27 November 2015

The Global Warming Policy Forum is calling on the Government to examine ways of speeding up shale gas exploration in the UK, following on from Lancashire County Council’s decision to reject Cuadrilla’s application for exploratory drilling at the Preston New Road site near Blackpool. The GWPF recommends that the Department of Energy and Climate Change should consider treating shale gas fields as Nationally Significant Infrastructure Projects (NSIPs), which would give the Secretary of State the final say on planning applications rather than local councils. —Global Warming Policy Forum, 29 June 2015

Dozens of small nuclear reactors should be installed throughout the country near towns and cities if the UK wants to reduce greenhouse gas emissions and keep the lights on, the former environment secretary, Owen Paterson, has said. “This is a well established technology,” he said in his first major speech since he was sacked in the summer Cabinet reshuffle. “We have nuclear plants in our submarines which are accepted.” The plan was among a set of energy measures Mr Paterson outlined on Wednesday in a lecture to the Global Warming Policy Foundation, which questions the cost of many climate change policies. –Pilita Clark, Financial Times, 15 October 2014

The UK could be the global centre of a new nuclear industry in mini-reactors that are trucked into a town near you to provide your hot water, or shipped to any country that wants to plug them into their electricity grid from the dock. The chancellor, George Osborne, revealed on Wednesday that at least £250m will be spent by 2020 on an “ambitious” programme to “position the UK as a global leader in innovative nuclear technologies”. “Small factory-built nuclear plants could be located closer, say within 20 to 40 miles, to users and provide a combined heat and power function,” said former UK environment secretary Owen Paterson [in his GWPF lecture] in 2014. –Damian Carrington, The Guardian, 24 November 2015

Britain is paying a steep price for degrading its electricity system. In addition to the heightened risk of power cuts, subsidizing renewables is forecast to cost electricity users £10 billion ($15.11 billion) a year by 2020. And that doesn’t include the cost of extra transmission infrastructure and the vast subsidies needed to induce investment in dependable generating capacity. The massive distortions created by subsidizing wind and solar leave the government facing a dilemma. Policy makers can accept that the market no longer works and replace it with a 21st-century form of nationalization, perhaps by having the state fund construction of the capacity it prescribes while private operators run it. Or Britain can end all subsidies for renewables and restore market disciplines and incentives for investment in reliable generating capacity. The government recognizes now the scale of the problem, but hasn’t yet figured a way out of the mess. Rupert Darwall, The Wall Street Journal, 27 November 2015

1) Stranded Assets: Solar Company Faces Biggest Bankruptcy In Spanish History

The Washington Times, 25 November 2015

Ben Wolfgang

One of the world’s biggest renewable energy companies, Spain’s Abengoa, has announced the start of insolvency proceedings. International banks’ total exposure to a full Abengoa bankruptcy stands at about $21.4 billion, meaning the company’s downfall would end up being the largest bankruptcy in Spanish history.

If you were wondering what the Spanish word for “Solyndra” is, this week provided the answer: “Abengoa.”

Abengoa is a Spanish company that was another of President Obama’s personally picked green energy projects, and it’s now on the verge of bankruptcy too, potentially saddling taxpayers with a multibillion-dollar tab and fueling the notion that the administration repeatedly gambles on losers in the energy sector.

The renewable energy firm, which is constructing several large-scale solar power projects in the U.S. and has received at least $2.7 billion in federal loan guarantees since 2010, said Wednesday it will begin insolvency proceedings, a technical first step toward a possible bankruptcy.

The news comes at an especially awkward time for Mr. Obama. On Sunday he’ll travel to Paris for a historic climate change summit and is expected to call on world leaders to reject fossil fuels and spend heavily on renewable energy, including solar power.

Abengoa’s looming demise is eerily reminiscent of the fall of solar power firm Solyndra in 2011, a colossal failure of government investment that left taxpayers on the hook for more than $530 million.

A potential Abengoa bankruptcy could be much worse for taxpayers, although it’s unclear how much of the guaranteed loans the company has paid back. Neither the White House nor the Energy Department responded to requests for comment Wednesday seeking information on how much the company still owes on the loans, for which the federal government might be left on the hook.

Critics say Abengoa is yet another reminder that the administration’s meddling in the energy sector — and its insistence that, with enough government financial backing, ambitious renewable projects can compete in the free market — leads to disaster for taxpayers.

“When you have a company that is based on subsidies, it is no surprise they run into financial trouble because their business model isn’t based on economics; it’s based on politics,” said Daniel Simmons, vice president for policy at the conservative Institute for Energy Research, a leading critic of the administration’s spending on renewable fuels and of the president’s energy policy more broadly.

“The government money fueled Abengoa’s growth. They fueled their desire to take on more debt. It’s now obvious they have a very serious debt problem,” Mr. Simmons added. “What is troubling is that if there are large projects that private-sector people think they’ll be able to make money on, there’s no need to take those projects to a government. That’s where these projects go wrong: thinking governments will necessarily make good investment decisions.”

Wednesday’s news sent Abengoa’s stock price falling by about 60 percent. International banks’ total exposure to a full Abengoa bankruptcy stands at about $21.4 billion, according to Reuters news agency, meaning the company’s downfall would end up being the largest bankruptcy in Spanish history.

2) New Survey: Public Support For Tough Climate Deal Declines

BBC News, 27 November 2015

Matt McGrath

Public support for a strong global deal on climate change has declined, according to a poll carried out in 20 countries. Only four now have majorities in favour of their governments setting ambitious targets at a global conference in Paris.

In a similar poll before the Copenhagen meeting in 2009, eight countries had majorities favouring tough action.

The poll has been provided to the BBC by research group GlobeScan.

Just under half of all those surveyed viewed climate change as a “very serious” problem this year, compared with 63% in 2009.

The findings will make sober reading for global political leaders, who will gather in Paris next week for the start of the United Nations climate conference, known as COP21.

It’s being billed as the best opportunity in six years to achieve a significant advance on tackling rising temperatures.

In 2009, in Copenhagen, the leaders failed to deliver a strong outcome despite widespread public expectation that a deal was needed.

The BBC asked the GlobeScan research group what their long-term polling suggested about public opinion on climate negotiations

Around 1,000 people in each of 20 countries were questioned about their attitudes. The survey was carried out in January and February of 2015.

Declining support

The number rating climate change as a very serious issue in richer countries declined significantly from 2009, while support for strong action at the Paris conference has only grown in three of the 20 countries polled.

3) At Last! Fracking To Start In Months As Minister Fast-Tracks Decisions

The Times, 27 November 2015

Ben Webster

Fracking could start in Britain within months after the government intervened to fast-track applications to drill shale gas wells in Lancashire.

Greg Clark, the communities secretary, wrote to lawyers for Cuadrilla yesterday saying that he had decided to have the final say on its appeals against Lancashire county council’s rejection of its fracking applications.

The government has pledged to go “all out for shale” and in August announced changes in planning rules under which such appeals “will be treated as a priority for urgent resolution”.

Under the new rules, Mr Clark can intervene in appeals by “recovering” them and deciding the outcome himself. Under the normal process, an independent planning inspector would make the decision after hearing all the evidence.

In the letter, Mr Clark said he had issued the direction “because the drilling appeals involve proposals for exploring and developing shale gas”. He said that this amounted to proposals “for development of major importance” which had “more than local significance”.

REMINDER: GWPF Calls On Government To Speed Up Shale Development

4) Many Green Power Farms Planned For UK ‘Will Not Be Built’

The Independent, 27 November 2015

Tim Bawden

Many of the new green power stations that were expected to spring up over the next decade will no longer be built, after subsidies for onshore wind and solar energy were slashed, campaigners have warned.

In a development that will make it even harder for Britain to meet its ambitious climate change targets, numerous projects, from large onshore windfarms to small household solar installations, are no longer expected to go ahead.

A series of renewable energy projects planned by major power industry players such as the Big Six providers EDF and Germany’s RWE Group, owner of nPower, have recently been scrapped and many others will fail to get off the ground in the first place, campaigners said.

The cancellation of so many renewable projects is particularly embarrassing as it comes days before the start of next week’s UN Climate Conference in Paris. David Cameron is among the 138 world leaders expected to attend the opening day of the conference, but his Government is facing increasing criticism for backing away from the green agenda. In Wednesday’s Spending Review, the Chancellor scrapped a £1bn pilot project to cut carbon emissions.

5) Reminder: Owen Patterson Calls For Mini-Nuclear Plants By The Dozen At GWPF Lecture

Financial Times, 15 October 2014

Pilita Clark

Dozens of small nuclear reactors should be installed throughout the country near towns and cities if the UK wants to reduce greenhouse gas emissions and keep the lights on, the former environment secretary, Owen Paterson, has said.

“This is a well established technology,” he said in his first major speech since he was sacked in the summer Cabinet reshuffle. “We have nuclear plants in our submarines which are accepted.”

But the benefit of building more reactors within 20 to 40 miles of users was that heat could be captured from them and used to warm buildings instead of being wasted, he added.

The plan was among a set of energy measures Mr Paterson outlined on Wednesday in a lecture to the Global Warming Policy Foundation, which questions the cost of many climate change policies.

6) George Osborne Puts UK At The Heart Of Global Race For Mini-Nuclear Reactors

The Guardian, 24 November 2015

Damian Carrington

The UK could be the global centre of a new nuclear industry in mini-reactors that are trucked into a town near you to provide your hot water, or shipped to any country that wants to plug them into their electricity grid from the dock.

The chancellor, George Osborne, revealed on Wednesday that at least £250m will be spent by 2020 on an “ambitious” programme to “position the UK as a global leader in innovative nuclear technologies”.

There will be a competition to identify the best value design of mini reactors – called small modular reactors (SMRs) – and paving the way “towards building one of the world’s first SMRs in the UK in the 2020s”. There is no shortage of contenders, with companies from the US to China and Poland all wooing the UK with their proposals.

With a crucial UN climate change summit in Paris imminent, the question of how to keep the lights on affordably, while cutting emissions, is pressing.

SMRs aim to capture the advantages of nuclear power – always-on, low-carbon energy – while avoiding the problems, principally the vast cost and time taken to build huge plants. Current plants, such as the planned French-Chinese Hinkley Point project in Somerset, have to be built on-site, a task likened to “building a cathedral within a cathedral”.

Instead, SMRs, would be turned out by the dozen in a factory, then transported to sites and plugged in, making them – in theory – cheaper. Companies around the world, including in Russia, South Korea and Argentina, are now trying to turn that theory into practice and many are looking at the nuclear-friendly UK as the place to make it happen. […]

“Small factory-built nuclear plants could be located closer, say within 20 to 40 miles, to users and provide a combined heat and power function,” said former UK environment secretary Owen Paterson [in his GWPF lecture] in 2014. Sherry asks: “Would people accept district heating from nuclear?”

7) Rupert Darwall: The Night Britain’s Lights Went Out

The Wall Street Journal, 27 November 2015

Green energy policies already are causing power shortages and the winter isn’t even at its coldest yet.

National Grid, the company responsible for keeping Britain’s lights on, declared last month that the margin between electricity supply and demand over the coming winter would be “tight but manageable.” Three weeks later, National Grid had to issue its first call in more than five years for emergency supplies to keep the grid stable. At midday on Nov. 4, it asked for an extra 500 megawatts for the 6:30 to 8.30 evening peak.

It was an unseasonably mild and windless day. A couple of coal plants nearing the end of their useful lives had gone offline due to the unreliability associated with age, some nuclear capacity was down for refueling, and Britain’s 13 gigawatts of wind capacity was producing only 0.6 gigawatts.

As prices spiked up to 40 times their normal level, 420 megawatts of electricity flowed into the grid from diesel and other small-scale generators. Large electricity users helped by reducing their demand by 40 megawatts under a prior arrangement, designed to help reduce peak loading when necessary—and were paid handsomely for slowing down their assembly lines and the like. If the temperature hadn’t been a balmy 14 degrees Celsius that day, an emergency might well have turned into a crisis.

On the face of it, there shouldn’t be a problem. At the end of last year, Britain had a registered capacity of 95 gigawatts, up from just more than 78 gigawatts in 2004. Over the same period, demand for electricity fell 17% due in part to milder winters, higher electricity prices and a large fall in industrial energy consumption.

But what this increase in registered capacity doesn’t show is the huge deterioration in the quality of Britain’s generating assets.

Britain has been focusing in recent years on developing its wind and solar capacity, instead of the kind that could dependably replace its aging coal and nuclear power stations. Since 2010, 21 gigawatts of coal, gas and nuclear power have been shut down. Only six gigawatts have been built. Once the intermittency of wind and solar is taken into account, the 95 gigawatts of nominal capacity drops to 85 gigawatts. Actual output produced by wind and sun can be much less, depending on the weather. On that windless November day, wind was generating only 5% of its registered capacity.

The position was very different 10 years ago. After privatization in 1990, the electricity regulator encouraged a degree of vertical integration to spur competition between generators, sparking a “dash for gas.” As a result, nearly half of Britain’s current generating capacity came online in this period. By 2004 Britain had a modern, high quality, flexible generating mix able to respond efficiently to changes in relative prices of oil, coal, gas and uranium.

That’s no longer true. Rather than modernizing coal-fired power stations to meet EU emissions standards, their condition has been allowed to deteriorate. Meanwhile Sizewell B, Britain’s youngest nuclear power station, is already 20 years old. A large chunk of the even older nuclear plants will reach the end of their lives in eight years’ time.

At the same time, scaling up government-subsidized wind power has destroyed the incentive to invest private money in modern, highly efficient combined-cycle gas turbines, which are not only very reliable but also are a far cheaper way of cutting carbon-dioxide emissions compared to subsidizing renewables. Despite their reliability and low emissions, these modern generators are not attractive to investors when they compete with subsidized renewable sources whose marginal cost of output is near zero.

Britain is paying a steep price for degrading its electricity system. In addition to the heightened risk of power cuts, subsidizing renewables is forecast to cost electricity users £10 billion ($15.11 billion) a year by 2020. And that doesn’t include the cost of extra transmission infrastructure and the vast subsidies needed to induce investment in dependable generating capacity.

To make up for some of the lost capacity, Britain is turning to China to finance, design, build and operate a new range of Chinese nuclear reactors. At this point, financing new generating capacity would cost consumers less if the state funded the investment directly, since spiraling electricity prices increase the premium private investors demand to compensate for the political risk that government might introduce further market distortions. But as Chancellor of the Exchequer George Osborne said during a recent trip to China, not spending billions of pounds on nuclear power stations frees up government money for other priorities.

The massive distortions created by subsidizing wind and solar leave the government facing a dilemma. Policy makers can accept that the market no longer works and replace it with a 21st-century form of nationalization, perhaps by having the state fund construction of the capacity it prescribes while private operators run it. Or Britain can end all subsidies for renewables and restore market disciplines and incentives for investment in reliable generating capacity. The government recognizes now the scale of the problem, but hasn’t yet figured a way out of the mess.