Are We Headed For An Electric Car Crisis?

Plug-in electric vehicles failed to win over U.S. consumers amid the auto industry’s record sales in 2015, as low gasoline costs and daunting sticker prices damped demand. Americans bought just 102,600 such vehicles in 2015, a 17 percent decline from the previous year, according to researcher Autodata. Persuading car buyers to choose electric got more difficult as gasoline slid to $2 a gallon by the end of last year. “Why should I go electric and pay more when gas is so cheap?” Ludwig Willisch, chief executive officer of BMW of North America, said in an interview. –Dana Hull, Bloomberg, 6 January 2016

The car industry has been moving towards more hybrids and EVs for some time, but this year’s CES almost made gas look like a thing of the past. Problem is, with gas so cheap in the U.S., nobody here is buying these things right now. Given the chance, Americans will default to bigger cars every time. Not hybrids and EVs, but trucks and SUVs. The result is what industry folks are calling a “two-tier market”: one market full of SUVs and trucks people actually buy, and one with the “money-losing compliance vehicles” of EVs and hybrids people aren’t buying. And if you’re an automaker without the intensive capital to develop those cars, you’re kinda screwed. —Patrick George, Jalotnik, 7 January 2016

1) Electric Cars Left Behind As Oil Price Plunges – Bloomberg, 6 January 2016

2) Detroit Auto Industry Is Changed, But Not As Obama Planned – Reuters, 11 January 2016

3) Are We Headed For An Electric Car Crisis? – Jalotnik, 7 January 2016

4) UK Market For Electric Cars Failing To Ignite, Warns Manufacturer – TransportXtra, 8 January 2016

5) Oil Price Plunge Is Good For Drivers, But It’s A Big Threat To The Green Agenda – International Business Times, 23 December 2015

6) North Sea Oil Faces Wipeout As Prices Keep Plunging – The Sunday Times, 10 January 2016

When U.S. President Barack Obama visits Detroit’s annual auto show on Jan. 20, exactly one year before he leaves office, he is expected to tout how much the industry has changed since he orchestrated a federally funded rescue in 2009. But many of the changes on display at the city’s annual auto show will not reflect the green-transport revival the president envisioned. The ‘Detroit Three’ automakers racked up record sales and profits in the U.S. market last year not because of electric cars or plug-in hybrids, but because of soaring demand for pickup trucks and sport utility vehicles fueled by gasoline prices that hit multi-year lows. –David Shepardson and Paul Ingrassia, Reuters, 11 January 2016

The UK Government’s hopes for a mass market in electric vehicles within the next 10-15 years could be doomed, an automotive manufacturer has warned. Ministers see electric vehicles as key to decarbonising the UK’s transport sector, and meeting the Climate Change Act 2008 target for an 80% reduction in greenhouse gases against 1990 levels by 2050. But an automotive firm has told the CCC that manufacturers are currently selling electric cars at a loss and the market is failing to grow in the way some forecasts predicted. –Andrew Foster, TransportXtra, 8 January 2016

While the persistent plunge in oil prices is good news for consumers at the gas pump, it’s bad news for some parts of the green economy. Lower fuel costs could choke off investment in some of the clean energy technologies needed to reduce planet-warming emissions and meet global climate change targets, analysts say. In the U.S., where the average gasoline price dropped below $2 a gallon this week, sales of fuel-efficient and lower-emissions vehicles are already giving way to gas-guzzling trucks and SUVs. –Maria Galluci, International Business Times, 23 December 2015

A desperate situation can sometimes be best summed up by numbers. Here’s one that neatly captures the effect the oil price crash has had on the London market. The combined market value of 112 publicly traded oil companies — the entirety of Britain’s listed industry excluding the top three of Shell, BP and BG — is the same as that of Marks & Spencer: £7bn. The primary culprit for this collective capsize is the oil price. In the North Sea this has led to a disastrous contraction, threatening an industry that employs more than 375,000 people and was, until recently, one of the richest sources of tax revenue for the exchequer. Last year the Office for Budget Responsibility predicted that 2016 tax revenue would fall to £600m, a 95% drop from the £12.9bn generated for the exchequer in 2009. Even that low figure may prove optimistic. –Danny Fortson, The Sunday Times, 10 January 2016

1) Electric Cars Left Behind As Oil Price Plunges

Bloomberg, 6 January 2016

Dana Hull

Plug-in electric vehicles failed to win over U.S. consumers amid the auto industry’s record sales in 2015, as low gasoline costs and daunting sticker prices damped demand.

Americans bought just 102,600 such vehicles in 2015, a 17 percent decline from the previous year, according to researcher Autodata. Nissan Motor Co. sold 43 percent fewer of its all-electric Leaf and General Motors Co. reported an 18 percent drop for its Chevrolet Volt, a plug-in model that’s driven by an electric motor and has a gasoline engine to recharge its batteries.

Persuading car buyers to choose electric got more difficult as gasoline slid to $2 a gallon by the end of last year. The average U.S. retail gas price for the full year was $2.40 a gallon, down from $3.34 in 2014, according to AAA. Add to that starting prices such as $29,010 for the Leaf, a small car, and even with government incentives such as a $7,500 federal tax credit, winning over customers can be difficult.

“Why should I go electric and pay more when gas is so cheap?” Ludwig Willisch, chief executive officer of BMW of North America, said in an interview. “There needs to be a clear advantage to driving electric: HOV lanes, parking, charging.”

2) Detroit Auto Industry Is Changed, But Not As Obama Planned

Reuters, 11 January 2016

David Shepardson and Paul Ingrassia

When U.S. President Barack Obama visits Detroit’s annual auto show on Jan. 20, exactly one year before he leaves office, he is expected to tout how much the industry has changed since he orchestrated a federally funded rescue in 2009. But many of the changes on display at the city’s annual auto show will not reflect the green-transport revival the president envisioned.

“We said the auto industry would have to truly change, not just pretend that it did,” the president said Saturday in a weekly radio address devoted to Detroit.

The ‘Detroit Three’ automakers racked up record sales and profits in the U.S. market last year not because of electric cars or plug-in hybrids, but because of soaring demand for pickup trucks and sport utility vehicles fueled by gasoline prices that hit multi-year lows.

3) Are We Headed For An Electric Car Crisis?

Jalotnik, 7 January 2016

Patrick George

If there’s one major automobile trend we’ve seen at the recent spate of trade shows, besides putting screens everywhere, it’s electrification. The car industry has been moving towards more hybrids and EVs for some time, but this year’s CES almost made gas look like a thing of the past. But is the U.S. also headed for an electric car crisis?

As they recover from Dieselgate, Volkswagen and Audi are going big on electric cars. So is Ford. So is Chevrolet. So is Mercedes and also pretty much everyone else. They’re doing this in part because electrification is likely the future of automobile transport, but more because ever-stricter government fuel economy and emissions requirements force them to.

Problem is, with gas so cheap in the U.S. right now, nobody here is buying these things right now. And if that trend continues it could mean costly headaches for car companies.

According to new data from Brandon Schoettle and Michael Sivak ofUniversity of Michigan’s Transportation Research Institute, the U.S.’ average fuel economy was down in 2015 compared to the previous year. They reported fuel economy is down 0.9 mpg from the peak reached in August 2014, but on the plus side, it’s still up 4.8 mpg from when the university began this study in 2007.

Why is the fuel economy average down when cars are ever more efficient? Since gas prices have been declining for a year now, and the national price of a gallon of unleaded is about $1.97 at the moment, Americans just aren’t making fuel-efficiency a priority with their new car choices. The biggest winners in 2015’s record-breaking new car-a-palooza were Jeep, Ram and any brand with a lot of SUVs, trucks and crossovers.

Given the chance, Americans will default to bigger cars every time. Not hybrids and EVs, but trucks and SUVs.

Granted, the hybrid market is still relatively small in the marketplace, though it’s growing quickly; and the EV charging infrastructure and charging times aren’t all where they need to be to meet most Americans’ needs yet. But the EVs and hybrids are coming fast, and with gas this cheap, who’s gonna buy them?

This “electric disconnect” is highlighted extremely well in this Detroit News story. Automakers are going green not just to save the planet, but because they have to: by 2020 California will require 10 percent of all sales to be EV or fuel cell cars, and nationally, fleets have to average 54.5 mpg by 2025. Right now, we’re at about 24.7 mpg. Oof.

The result, the News points out, is what industry folks are calling a “two-tier market”: one market full of SUVs and trucks people actually buy, and one with the “money-losing compliance vehicles” of EVs and hybrids people aren’t buying. And if you’re an automaker without the intensive capital to develop those cars, you’re kinda screwed.

4) UK Market For Electric Cars Failing To Ignite, Warns Manufacturer

TransportXtra, 8 January 2016

Andrew Foster

The Government’s hopes for a mass market in electric vehicles within the next 10-15 years could be doomed, an automotive manufacturer has warned.

Ministers see electric vehicles as key to decarbonising the UK’s transport sector, and meeting the Climate Change Act 2008 target for an 80% reduction in greenhouse gases against 1990 levels by 2050.

In recent advice to ministers on the fifth carbon budget (2028-2032), the Committee on Climate Change (CCC) says that, under a central scenario, plug-in hybrids and battery electric vehicles should account for 9% of UK new car and van sales by 2020 and around 60% by 2030.

But an automotive firm has told the CCC that manufacturers are currently selling electric cars at a loss and the market is failing to grow in the way some forecasts predicted.

The company’s comments have just been released by the CCC. The identity of the firm has been anonymised – it is described as an OEM (an original equipment manufacturer), a term used to describe manufacturers involved in vehicle assembly.

“Many OEMs including ourselves have invested billions of Dollars/Euros/Yen etc. in the development of Ultra Low Emission Vehicles (ULEVs) – i.e. plug-in EVs/range-extenders/

PHEVs/hydrogen vehicles – but the market forecasts for the uptake of EVs in particular have not materialised,” says the firm.

“Many ULEVs today are sold at a loss in the expectation/hope that at some stage the market will take-off but in the current economic climate this cannot be maintained.

“The battery technology itself is still hugely expensive and, without mass market take-up, predicted economies of scale will continue to go unrealised.

“Whilst legislation in the form of Government targets gives OEMs direction, these should also be realistic.

“There has been a massive push on ULEVs over the past four years and, whilst take-up is increasing, it still represents a small proportion of the car market.

“Without a step-change in battery technology and efficiencies from economies of scale the prospect of 40-50% of the market being plug-in by 2030 looks highly unlikely and may potentially only be achievable through sustained significant government incentives.”

The firm warns of “£m’s of taxpayers’ money being spent on an infrastructure that will go largely unused – £m’s that could be better spent on purchase incentives for the ULEVs themselves”.

5) Oil Price Plunge Is Good For Drivers, But It’s A Big Threat To The Green Agenda

International Business Times, 23 December 2015

Maria Galluci

While the persistent plunge in oil prices is good news for consumers at the gas pump, it’s bad news for some parts of the green economy. Lower fuel costs could choke off investment in some of the clean energy technologies needed to reduce planet-warming emissions and meet global climate change targets, analysts say.

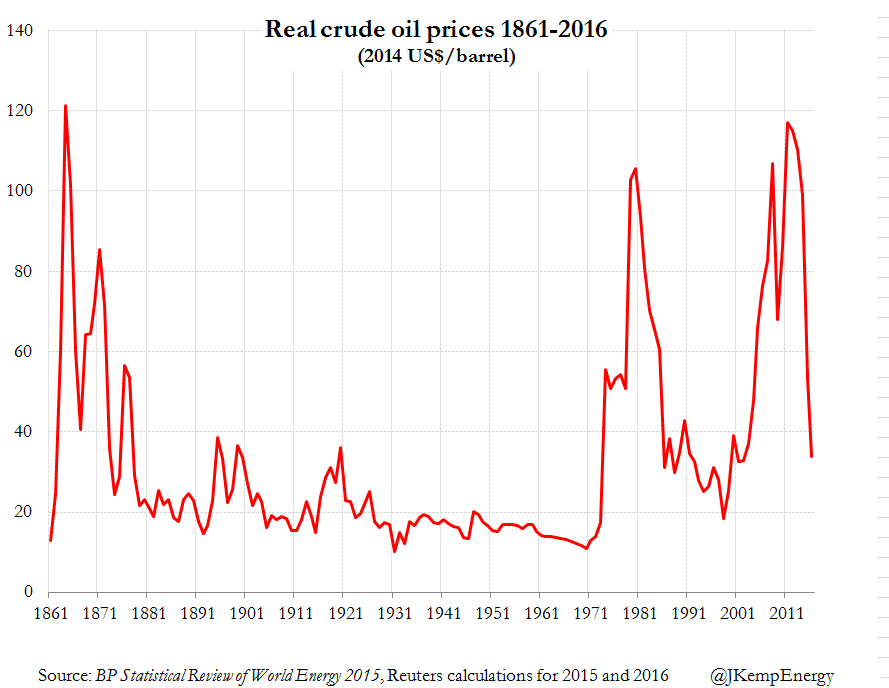

Oil prices have nose-dived over the last year and a half, plunging by nearly two-thirds from a peak in June 2014. Crude supplies are surging as oil demand wanes in emerging economies, leaving the world with an oversupply of as much as 2 million barrels a day this year…

The oil slump is particularly challenging for alternative transportation technologies, which compete directly with gasoline and diesel for investor and consumer dollars. Cheaper oil means biofuels made from algae or wood scraps are increasingly more expensive than petroleum-based fuels, and thus riskier investments. Fuel-efficient vehicles or battery-powered cars similarly lose their luster for new car buyers compared to cheaper conventional models.

If the cost of crude remains near $50 a barrel through 2020, cheaper gasoline and diesel could hold back the development of emissions-cutting electric cars and biofuels, the International Energy Agency (IEA) recently estimated. The Paris institution projected around $800 billion of efficiency improvements in cars, trucks and airplanes would be lost if crude prices stay around today’s levels.

In the U.S., where the average gasoline price dropped below $2 a gallon this week, sales of fuel-efficient and lower-emissions vehicles are already giving way to gas-guzzling trucks and SUVs.

“Consumers are purchasing bigger cars again, thinking that low gas prices are here to stay,” said Nick Nigro, founder of the technology consulting firm Atlas Public Policy in Washington, D.C.

The average fuel economy of new vehicles sold in the U.S. has dropped by 0.8 miles per gallon since August 2014, the University of Michigan Transportation Research Institute found in early December. Sales of electric and hybrid vehicles could fall below 500,000 cars this year, down about 16 percent from a peak of more than 592,000 vehicles sold in 2013, according to the Electric Drive Transportation Association.

Curbing emissions from tailpipes and engines is key to limiting global warming: The transportation sector makes up nearly one-fourth of global carbon dioxide emissions from energy, the IEA has estimated. Energy sources on the whole — including vehicles, electricity and industrial activity — account for about two-thirds of the world’s overall greenhouse gas emissions.

6) North Sea Oil Faces Wipeout As Prices Keep Plunging

The Sunday Times, 10 January 2016

Danny Fortson

Exploration has been cut right back, jobs are being slashed, operators are going bust and there is no relief in sight

A desperate situation can sometimes be best summed up by numbers.

Here’s one that neatly captures the effect the oil price crash has had on the London market. The combined market value of 112 publicly traded oil companies — the entirety of Britain’s listed industry excluding the top three of Shell, BP and BG — is the same as that of Marks & Spencer: £7bn.

Two years ago, just one of the 112 — Tullow Oil — was worth more than Britain’s preferred seller of sandwiches and underwear, with a healthy £8.2bn market value. Its fall has been stunning. As the numbers above attest, it is but one of many.

The primary culprit for this collective capsize is the oil price. Brent crude has plunged 70% from $115 in the summer of 2014 to $33 a barrel last week amid a prolonged price war between Saudi Arabia, the world’s largest producer, and American shale drillers. Such a dramatic collapse in the value of the only product these companies sell has, predictably, wreaked havoc.

The problem is that as 2016 begins many companies that clung on by their fingertips last year, hoping to ride out the storm, are finally buckling as the global glut of crude deepens.

In the North Sea this has led to a disastrous contraction, threatening an industry that employs more than 375,000 people and was, until recently, one of the richest sources of tax revenue for the exchequer.

Last year the Office for Budget Responsibility predicted that 2016 tax revenue would fall to £600m, a 95% drop from the £12.9bn generated for the exchequer in 2009. Even that low figure may prove optimistic.

Already, 65,000 jobs have been lost. The government’s Oil and Gas Authority (OGA) has launched an array of programmes to jolt the sector into life, from carrying out seismic analysis of new frontiers to forcing owners of pipelines to open their infrastructure to smaller developers. OGA chief executive Andy Samuel said: “Our role as an urgent catalyst for change is more significant than ever.”

The results have, so far, been negligible. According to specialist consultancy Hannon Westwood, companies are expected to drill just six exploration wells this year. That would be the lowest number since 1964, when the UK Continental Shelf Act threw open the region to explorers. The previous low was 13, set last year.

The drilling drought means that as decades-old fields run dry, there will be few new projects to replace them, pushing the North Sea closer to terminal decline.