GWPF | 10 Dec 2014

North America To Flood The World With Cheap & Abundant Fossil Fuels

The world’s largest oil company sees emissions in the developing world surging 50 percent, a forecast that suggests the diplomatic push to draft an accord to curb global warming stands to fall short. Even as the most advanced economies cut energy use by almost one tenth through 2040 and add hundreds of millions of fuel-efficient vehicles, booming growth in places like India, South Africa and Thailand will boost demand for fuels 36 percent, the Irving, Texas-based company said in its annual outlook. Emissions will surge as an expanding middle class in poorer nations demands electricity, schools and hospitals. –Joe Carroll, Bloomberg, 10 December 2014

Low oil prices and the inaction of OPEC may well result in a shale crash next year. Many analysts now expect falling oil prices to throttle the US shale boom. The theory goes that, if high prices helped create the oil boom in USA and Canada, then low prices will inevitably result in a shale crash. That’s certainly what Saudi Arabia, the leading member of OPEC, are hoping. However, according to The Economist, ‘adversity will make shale stronger.’ The success of North American shale has been recognised globally and now many other countries are now hoping for similar success (Mexico and the UK being two of the most prevalent). And, when oil prices recover, new wells can be purchased within weeks – it won’t take long to get North American shale production creaking back into action again. –Jeremy Coward, Shale World, 10 December 2014

A $200 million government backflip on an international green climate fund will come at the expense of Australia’s foreign aid budget. In a bittersweet victory for green groups, Foreign Minister Julie Bishop today announced to a UN climate change conference in Lima that Australia would now contribute to a $10 billion fund that aims to help developing nations tackle global warming. The decision is a reversal of its stance at the G20 summit in November. Mr Abbott said money from the fund would be “strictly invested in practical projects in our region” including energy efficiency, better infrastructure, reforestation and carbon offsets. –Dennis Shanahan, The Australian, 10 December 2014

1) New Report: North America To Flood The World With Cheap & Abundant Fossil Fuels – Associated Press, 9 December 2014

2) Exxon Issues Energy Reality Check As UN Debates CO2 Emissions – Bloomberg, 10 December 2014

3) 2015 Will See A Shale Crash… With A Rapid Rebound – Shale World, 10 December 2014

4) Australia Bows To Green Pressure, Pledges $200 Million To UN Climate Fund – The Australian, 10 December 2014

1) New Report: North America To Flood The World With Cheap & Abundant Fossil Fuels

Associated Press, 9 December 2014

Jonathan Fahey

North America, once a sponge that sucked in a significant portion of the world’s oil, will instead be supplying the world with oil and other liquid hydrocarbons by the end of this decade, according to ExxonMobil’s annual long-term energy forecast.

And the “almost unspeakable” amount of natural gas found in recent years in the U.S. and elsewhere in North America will be enough to make the region one of the world’s biggest exporters of that fuel by 2025, even as domestic demand for it increases, according to Bill Colton, Exxon’s chief strategist.

“The world has such an improved outlook for supplies,” Colton said in an interview. “Peak oil theorists have been run out of town by American ingenuity.”

In a forecast that might make economists happy but environmentalists fret, Exxon’s two chief products, oil and natural gas, will be abundant and affordable enough to meet the rising demand for energy in the developing world as the global middle class swells to 5 billion from 2 billion and buys energy-hungry conveniences such as cars and air conditioners.

This is a result of advances in drilling technology that have made it possible for engineers to reach oil and gas in unconventional rock and extreme locations and quieted talk that the world was quickly running out of oil.

And it is despite what Exxon assumes will be increasingly strict policies around the world on emissions of carbon dioxide and other gasses emitted by fossil fuel use that scientists say are triggering dangerous changes to the world’s climate.

Exxon’s outlook forecasts world energy supply and demand through 2040 and is updated every year. It is noted by investors and policymakers and used by Exxon to shape its long-term strategy. Colton said the recent sharp decline in oil prices does not have much effect on the company’s long-term vision, and that the company expects prices to rise and fall, sometimes dramatically, throughout the period.

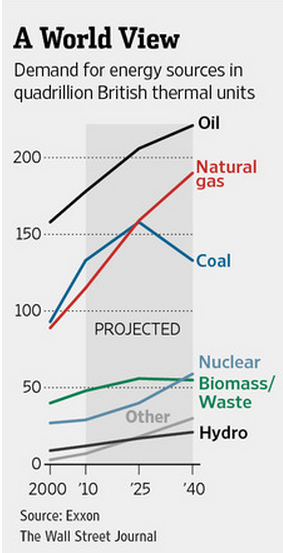

Exxon’s vision is broadly similar to that of other forecasters, including those by the International Energy Agency, which released its most recent long-term forecast last month. Demand for energy will grow rapidly in coming decades in the developing world, while demand in the developed world is expected to be flat or even decline as countries impose stricter emissions policies and become more efficient.

The use of coal, now the world’s second most important fuel after oil, will eventually slip as countries try to reduce air pollution and greenhouse gas emissions. Natural gas, which burns cleaner than coal and emits half the global warming gases as coal, will supplant coal in the number two spot.

2) Exxon Issues Energy Reality Check As UN Debates CO2 Emissions

Bloomberg, 10 December 2014

Joe Carroll

The world’s largest oil company sees emissions in the developing world surging 50 percent, a forecast that suggests the diplomatic push to draft an accord to curb global warming stands to fall short.

The assessment, in a report today from an Exxon Mobil Corp. team of economists, scientists and engineers, shows how far the world is from cutting pollution blamed for climate disruption. It comes as UN Secretary-General Ban Ki-Moon warned envoys today at United Nations talks in Lima that the “window of opportunity” to slow climate change is closing.

Even as the most advanced economies cut energy use by almost one tenth through 2040 and add hundreds of millions of fuel-efficient vehicles, booming growth in places like India, South Africa and Thailand will boost demand for fuels 36 percent, the Irving, Texas-based company said in its annual outlook. Emissions will surge as an expanding middle class in poorer nations demands electricity, schools and hospitals.

“It is simply not possible to obtain significant reductions in greenhouse gases without engaging the developing world,” Bill Colton, Exxon’s vice president of corporate strategic planning, said during a webcast today.

3) 2015 Will See A Shale Crash… With A Rapid Rebound

Shale World, 10 December 2014

Jeremy Coward

Low oil prices and the inaction of OPEC may well result in a shale crash next year. However, experts claim that any crash will be followed by a quick global recovery.

The shale energy revolution in the United States has been the envy of the business world. The American shale industry is currently responsible for 3.7% of the total global supply, which has risen from very humble beginnings (0.8% in 2008).

However, many now expect falling oil prices to throttle the US shale boom. The theory goes that, if high prices helped create the oil boom in USA and Canada, then low prices will inevitably result in a shale crash. 2014 has seen the cost of a barrel of oil (42 gallons) fall from $100 in July to below $70 in just a few months. The International Energy Agency (IEA) predicts that US shale production will start slacking if these low prices continue into 2015.

That’s certainly what Saudi Arabia, the leading member of OPEC, are hoping. Rather than looking to stabilise oil prices, they appear to be letting the prices fall further, in order to put high-cost shale firms out of business.

Whether US shale firms remain profitable depends on what the ‘break-even price’ for those firms is – that’s the price required for drilling projects to be profitable and offer a good return on investment. The IEA believes that at least 4% of US shale-oil projects have already fallen below this price. By contrast, Bernstein Research estimates that 1/3 of US shale projects will become unprofitable if prices remain below $80 a barrel.

Hence why it is possible that, next year, we will see the shale production in North America grind to a halt and perhaps even decline. This will be the result of investment cuts, which will become more and more likely to as 2015 progresses.

So Saudi Arabia and OPEC may see their wish granted next year. However, according to The Economist, ‘adversity will make shale stronger.’ The success of North American shale has been recognised globally and now many other countries are now hoping for similar success (Mexico and the UK being two of the most prevalent). And, when oil prices recover, new wells can be purchased within weeks – it won’t take long to get North American shale production creaking back into action again.

4) Australia Bows To Green Pressure, Pledges $200 Million To UN Climate Fund

The Australian, 10 December 2014

Dennis Shanahan

A $200 million government backflip on an international green climate fund will come at the expense of Australia’s foreign aid budget.

In a bittersweet victory for green groups, Foreign Minister Julie Bishop today announced to a UN climate change conference in Lima that Australia would now contribute to a $10 billion fund that aims to help developing nations tackle global warming.

It came after the Prime Minister revealed a “fair and reasonable” contribution to the Green Fund based on caring for rainforests in South East Asia.

The decision is a reversal of its stance at the G20 summit in November.

But the $200m pledge will come from an already-plundered foreign aid budget.

Cabinet finalised the decision on Australia’s contribution to the fund — which Mr Abbott has criticised in the past — with the input of Julie Bishop from the climate conference in Lima. The contribution of $200m will be paid over four years, bringing total international contributions to the fund to over the target of USD$10 billion.

Mr Abbott defended the government’s “fair and reasonable” change of mind on the fund, which he last year criticised as “a Bob Brown Bank on an international scale”.

“Look, I’ve made various comments some time ago but as we have seen things develop over the last few months, I think it’s now fair and reasonable for the government to make a modest, prudent and proportionate commitment to this climate mitigation fund,” Mr Abbott said.

“I think that is something that a sensible government does. As I have always said, we have been doing a lot to combat climate change … and part of that is being a good international citizen.”

Mr Abbott said money from the fund would be “strictly invested in practical projects in our region” including energy efficiency, better infrastructure, reforestation and carbon offsets.

Full story